Monthly GDP rose 0.3% in January on the heels of a sharp, 1.0% increase in December. The January increase was more than doubly accounted for by a large increase in nonfarm inventory investment. Final sales declined in January, primarily reflecting declines in net exports, capital goods, and construction; PCE rose in January. The level of GDP in January was 4.4% above the fourth-quarter average at an annual rate. Implicit in our latest tracking forecast of 2.7% GDP growth in the first quarter is a 0.8% (monthly rate) decline in February that mainly reflects our assumption that nonfarm inventory investment stalls then.

This is from a commentary that was published on March 14, 2013.

Technical Note

Macroeconomic Advisers’ index of Monthly GDP (MGDP) is a monthly indicator of real aggregate output that is conceptually consistent with real Gross Domestic Product (GDP) in the NIPA’s. The consistency is derived from two sources. First, MGDP is calculated using much of the same underlying monthly source data that is used in the calculation of GDP. Second, the method of aggregation to arrive at MGDP is similar to that for official GDP. Growth of MGDP at the monthly frequency is determined primarily by movements in the underlying monthly source data, and growth of MGDP at the quarterly frequency is nearly identical to growth of real GDP.

Contact Macroeconomic Advisers

-

There was a lot to like in this morning's report on the employment situation in February.

- Nonfarm payroll employment rose 236 thousand, well above expectations.

- The unemployment rate declined two-tenths to 7.7%.

- The hours index rose five-tenths, reflecting both a solid increase in private employment (246 thousand) and an increase in the workweek.

- The breadth of the strength in employment was encouraging. Of note was a 48 thousand increase in construction employment, which was the largest one-month gain since early 2007.

This morning's report is indicative of an improving trend in payroll gains and a healthy dose of momentum early in the year.

- Over the last 4 months, payroll gains have averaged 205 thousand per month.

- This is up from gains averaging 154 thousand per month over the prior 4 months.

- The large gain in employment in February suggests a bit more positive momentum in the economy than was generally appreciated.

The implications for the near-term outlook were positive, but modest.

- While employment and hours in February far exceeded expectations, revisions to previous months were not favorable in terms of their implications for Q1 growth -- growth of employee hours in December was revised up and growth in January was revised down.

- Combined with unexpected weakness in the hours of the self-employed, this suggests an upward revision to our forecast for growth of hours worked in the nonfarm business sector in the first quarter of only two tenths (to 1.8%).

- Average hourly earnings posted a trend-like, 0.2% increase in February. Combined with the unexpected strength in hours, this suggests a few tenths more growth of wage and salary income in the first quarter than we previously expected.

- This, in turn, translates into modest upside risk to our latest forecast of 1.6% PCE growth in the first quarter, but not enough to warrant a tracking update.

There are other reasons not to get carried away.

- While this morning's employment report was unexpected and encouraging, it's important to keep in mind that the effects of this year's tax increase and sequester have yet to be felt fully.

- To be sure, payroll gains in line with the recent trend (about 200 thousand per month) would put the labor market on a healthy trajectory.

- However, we expect that fiscal drag now coming on line should soften the trend in payroll employment over the next few months, so we expect the pace of employment gains to slow relative to the trend of the last few months.

This is from a commentary that was published on March 8, 2013.

Contact Macroeconomic Advisers -

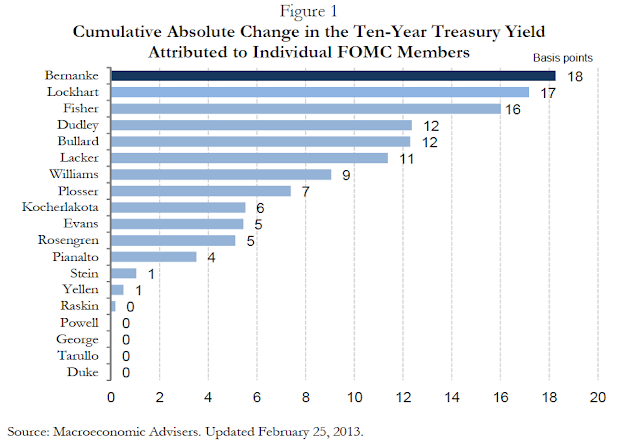

In this latest edition of our annual commentary, we look at how FOMC members moved markets last year.

- In a departure from previous years, we examine the impact of FOMC participants' speeches on the ten-year Treasury yield (instead of the two-year yield).

- The two-year yield today is pinned down by the FOMC's very explicit funds rate guidance, which suggests no rate hikes over the next two years.

- The combination of the funds rate guidance and very low yields has left very little room for the two-year yield to respond to FOMC speeches.

- And the winner is: Chairman Bernanke! On a cumulative basis, he moved the ten-year yield by 18 basis points.

- The two runners-up were Presidents Lockhart and Fisher. President Bullard, last year's winner in a rare upset, virtually tied for fourth place with President Dudley.

- Some FOMC members speak more often than others and thus have more opportunities to move the market.

- For instance, President Fisher had by far the largest number of speeches included in our analysis (22).

- On a per-speech basis, the Chairman also came in first. President Lockhart was the runner-up, with President Lacker third.

- This award goes to the entire Board of Governors (other than the Chairman).

- Governors spoke little compared to the rest of the Committee and had a net impact of only -1/2 basis point.

- On a per-event basis the impact of speeches on the ten-year yield was less than one-third that of FOMC minutes and statements.

- Minutes, statements, and the Chairman's press briefings were more influential on markets than speeches by the Chairman.

Every year we write a special issue of our Fixed Income Focus series devoted to gauging the market impact of Fed speeches and other forms of communications. We rank FOMC members according to the effects of their speeches on interest rates. This year, we used the same methodology as in previous years with one notable exception: We look at the ten-year Treasury yield rather than the two-year Treasury yield. The two-year yield has been pinned down by the FOMC's increasingly explicit funds-rate guidance that, we would argue, has made the two-year yield less responsive to Fed speeches. In contrast, one could argue that the ten-year yield has become more sensitive to Fed speeches given that QE tends to have a greater impact on the longer end of the curve.

We examine the market effects not only of speeches, but also of television and radio broadcast interviews. For simplicity, however, unless otherwise noted, we refer to all individual communications by members as speeches-except the Chairman's semiannual monetary policy testimonies before Congress and his post-meeting press conferences.[1]

We consider only those speeches that have at least some forward-looking content on monetary policy or the economic outlook. We measure the market impact of a speech as the change in the ten-year Treasury yield over a window that normally begins 15 minutes before and ends two hours after the speech. When economic data releases or Treasury auctions interfere with this 2-1/4-hour window, we either adjust the window or exclude the speech. This helps us better isolate the market impact of the speeches included in our analysis.[2] We generally exclude speeches with coinciding start times.

We also look at the market impact of official FOMC communications, such as FOMC statements and minutes. We include the Chairman's semiannual monetary policy testimonies and press conferences in the FOMC communications category because these are events where the Chairman is effectively speaking on behalf of the Committee.

Market Reaction to Speeches by Individual FOMC Members

Figure 1 shows the sum of the absolute value of the impact on the ten-year Treasury yield of each member's public speeches. Chairman Bernanke tops the list with a total impact of 18 basis points. President Lockhart came in second place with an impact of 17 basis points, and President Fisher was third with about 16 basis points. The previous year's winner, President Bullard, came in virtually tied for fourth place with President Dudley.

With the exception of the Chairman, the most impactful speakers last year were all Bank presidents. The greater market impact of presidents is not at all surprising. First, the Board acts as a team, and teams follow the leader.[3] As such, governors are more reluctant to take positions in public that differ from those of the Chairman. Governors more often clarify the view of the FOMC rather than question it. To us, this implies that governors' speeches are less likely to generate "news" than presidents' speeches. Second, only a few members of the Board, especially for the current Board, have a background that makes them comfortable talking about the outlook and monetary policy. So governors not only tend to make less news, they also tend to talk less often than presidents.

Who Talked the Most

Figure 2 shows, for each member, the total number of speeches that were included in our database for 2012. Overall, we examined 133 speeches by FOMC members: 116 speeches by presidents, 12 by the Chairman, and 5 by other Board members. President Fisher had the most speeches included in our analysis (22), close to his 2011 total of 21. President Bullard was second with 14, although he likely holds the record with 36 speeches in 2010. Chairman Bernanke came in tied for fourth. As we indicated above, other governors spoke relatively infrequently. Vice Chair Yellen, the most frequent speaker other than the Chairman, gave only two monetary policy-relevant speeches last year.[4]

The new Board members, Governors Powell and Stein, followed Board tradition and stayed below the radar, speaking little publicly. Governor Stein did give some more-theoretical but still policy-relevant speeches on asset purchases toward the end of the year. We were able to include one of those speeches in our sample.

Market Response Per Speech

The results in Figure 1 do not account for the fact that some FOMC members speak more often than others and, thus, have more opportunities to affect market prices. Figure 3 presents the average absolute market response per speech for FOMC members. The average market impact per speech by presidents was about 0.9 basis point; the average market impact of governors, other than the Chairman, was a third as great, at 0.3 basis point. This is consistent with our observation above about presidents' greater propensity, relative to Governors other than the Chairman, to deliver market-impacting speeches.

Chairman Bernanke had the largest impact per speech, 1.5 basis points, followed by President Lockhart at 1.3 basis points. President Lockhart is considered a centrist and perhaps his remarks are closely scrutinized by the market for signs of where the Committee's consensus might be headed. President Lacker, who dissented at every meeting in 2012 and consistently pushed back against the center-dove coalition, led the rest of the pack on an impact-per-speech basis. President Fisher, the most frequent FOMC speaker last year, was not very impactful on a per-speech basis.

Directional Bias and “Market Neutrality”

We also examined the net directional effect of each FOMC member on Treasury yields, measured as the sum of the market impact of his or her speeches. On net, FOMC speeches increased yields by about 11 basis points in 2012. This suggests that last year's speeches tended to be interpreted as more hawkish than expected. Of course, what matters for the market response is the extent to which each speech surprises relative to market expectations. So, even a hawkish speech by a hawk can drive yields lower if the speech is less hawkish than anticipated. A case in point is President Plosser, a solid hawk whose speeches apparently contributed to a 6-basis-point decline in the ten-year yield. Closer to the other end of the spectrum, President Dudley's speeches were apparently seen as less dovish than anticipated, adding 5 basis points to the ten-year yield last year, on net.

The Chairman had the greatest negative cumulative impact on yields, -6 basis points. This is not surprising because the FOMC was easing in 2012. President Bullard had the greatest positive cumulative impact, 7-1/2 basis points.

Some members on the Committee-typically governors other than the Chairman-pride themselves on having a very small impact on markets. In effect, they choose not to compete for the "I Moved Markets" award. In recognition of these members, we offer the "Market Neutrality" award, which of course goes to the FOMC member with the least net impact on the markets. But in 2012 a number of governors had zero net impact on the ten-year yield. So, in a departure from tradition, we give that award to "the governors" (excluding the Chairman). As a group, they had a net impact of only -1/2 basis point, though we should point out that the market neutrality of three of the governors (Duke, Powell, and Tarullo) simply reflects that we were able to include none of their speeches.

Impact of FOMC “Official” Communications on Yields in 2012

Figure 5 compares the market impact in 2012 of official communications by the Committee-statements, minutes, press conferences, and the Chairman's monetary policy testimonies-to the market impact of speeches. The figure suggests that, for all the attention and press coverage devoted to speeches in general, on a per-event basis, official FOMC communications were far more market influential than speeches last year.

Not even the Chairman's speeches were more influential than official communications. For instance, the average market impact of his speeches (see Figure 3) was around half that of FOMC statements.

In 2012, FOMC statements had the largest impact per event, 3-1/2 basis points. Next came the FOMC meeting minutes and the Chairman's press briefings, at around 3 basis points, followed by the Chairman's monetary policy testimonies, at 2-3/4 basis points.[5] The substantial impact of the minutes and press briefings may reflect that these proved to be excellent guides to the evolving Committee consensus in 2012, often providing the first signals of an emerging consensus.

[1] By "members," we mean all Board Governors (including the Chairman) and all Federal Reserve Bank presidents, including those who did not vote last year.

[2] Of course, we are aware that many other factors, including noise, drive fluctuations in yields. Our assumption here is that they average out to zero during the measurement window, such that we attribute the full movement in the ten-year yield within the window to the news element in the speech.

[3] See our Policy Focus commentary, "Counting Heads: Does it Matter?" July 1, 2010, for a discussion of the voting behavior of governors.

[4] As noted previously, we had to exclude a large number of speeches from our analysis because they happened to be scheduled for roughly the same time as another speech or market-moving event.

[5] Note that the FOMC's projections are released in the Summary of Economic Projections just before the press conference, so it is hard to disentangle the effects of the two events.

This is from a commentary that was published on March 8, 2013.

Contact Macroeconomic Advisers